Driven by changing population demographics worldwide, the medical equipment market is on the rise. Several different analysts predict increasing sales, with estimated compound annual growth rates (CAGRs) ranging from 4.5% to 6.3%. Those numbers aren’t huge but they are steady, and in a market that is already worth hundreds of billions of dollars, it doesn’t take enormous growth to create healthy opportunities for players across the industry. At Motion Solutions, we have many customers in the medical diagnostics and medical therapeutics markets. We consider it our responsibility to ensure that we are able to meet their needs for engineered solutions, whether in the form of engineering services or manufacturing, designed and built in our ISO 13485-certified facility.

Growth factors

From the time they were children, the post-World War II baby boom generation changed the way the world works. They triggered massive infrastructure spending in education, demonstrated the effect of teenage buying power and young-adult political power, then brought their influence into the sphere of work and family. Now, as they move into retirement and beyond, their effect continues. In part as a result of this graying population worldwide, chronic diseases are on the rise.

Baby boomers don’t tell the whole story, however. Despite the interest in health, the overall population has a higher incidence of chronic disease than ever before. The exact cause is a matter of debate – some cite environmental and lifestyle factors while others point to improved and more widely available diagnostics, as well as more comprehensive reporting standards. The key is that the disease exists and demands better tools for diagnosis and treatment.

By the numbers

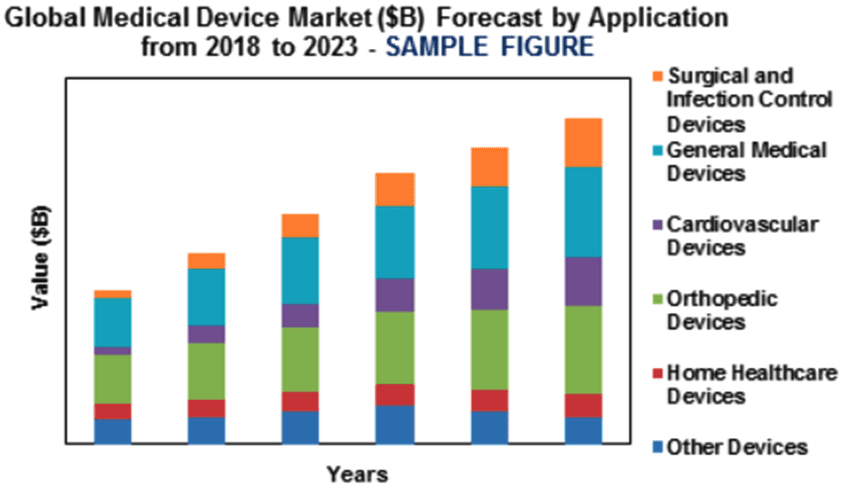

The global medical devices market should expand at a CAGR of 4.5% over the next four years, reaching a total of $409.5 billion by the year 2023, says a new report by Lucintel. In addition to the drivers identified above, the analyst points to increased spending by providers. “The future of the global medical device market looks good, with opportunities in public and private hospitals,” says the report. The surgical device sector should remain the largest over the survey period. Factors for device manufacturers to keep in mind include a focus on smaller devices and patient-portable devices, the use of software as a differentiator, and the importance of innovation.

A separate report by Technavio predicts a CAGR in the medical device sector of 5% globally over the period from 2018 through 2022. The US market currently dominates healthcare spending with a market share of nearly 45%; followed by Europe, the Middle East, and Africa (EMEA); and the Asia-Pacific region (APAC). Growth in the Asia-Pacific region will be highest over the over the forecast period, followed by EMEA, making them good targets for medical device innovators. By the end of the forecast period, healthcare spending in emerging markets will account for 30% of overall spending. “Apart from increasing market penetration in emerging countries, the increasing initiatives and awareness by public and private organizations, technological advances and new product launches, along with strategic M&As, will boost the growth of the global medical devices market during the forecast period,” says a senior analyst at Technavio.

The final report snapshot covers durable medical equipment, calling for a CAGR of 6.3% over the forecast period of 2019-2024. Market drivers include an established healthcare infrastructure, strong medical device multinationals, and well-organized reimbursement policies. The analysts expect APAC to lead growth, driven by rising R&D expenditures by governments and private-sector healthcare companies. “There is an increase in the number of hospitals across the developing and developed nations,” the report says. “[These facilities] have well-equipped surgical equipment, such as wheelchairs, beds, walkers, bathroom safety devices, monitoring and therapeutic devices, and other equipment.” The increased economic growth in the area has provided more funding for medical treatment, increasing opportunities for providers and the OEMs who supply them.

At Motion Solutions, we always believed in the value of innovation – supporting innovators is part of our mission. It’s important to remember that the largest part of the medical market consists of consumables – IV tubing, syringes, even the lowly cotton ball. Medical equipment carries a higher price tag but has fewer entry points for products that have already saturated the market. The exception is innovative devices, whether they perform an existing treatment more effectively or whether they offer something entirely new. Our role is to take responsibility for the motion part of a system in order to help innovators get their products to market more quickly.

About the Author

Scott Depenbrok is president at Motion Solutions.